Talks commenced June 2025 – a rare, past-producing, high-grade epithermal gold asset in Japan’s most prolific gold district

1. The Opportunity – why now?

In June 2025 Lithireum Inc. opened exclusive negotiations to purchase 100 % of Nagano Kin Co., Ltd., the private Japanese company that holds the 1.42 km² Yamagano mining licence in southern Kyushu.

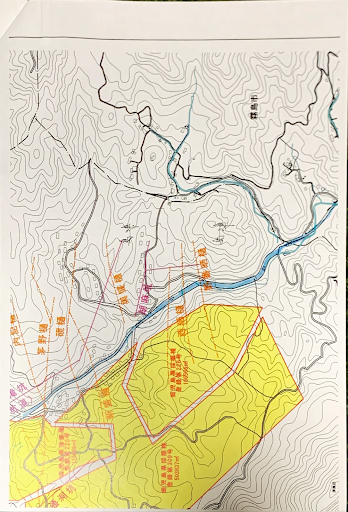

The acquisition – expected to close Q-4 2025 – would give Lithireum immediate ownership of a 400-year-old, past-producing gold mine that has never been drilled below 150 m and sits on the same structural trend as the 7.9 Moz Hishikari mine, only 11 km away.

2. Current Position – What is there today?

| Status (Sept 2025) | Detail |

|---|---|

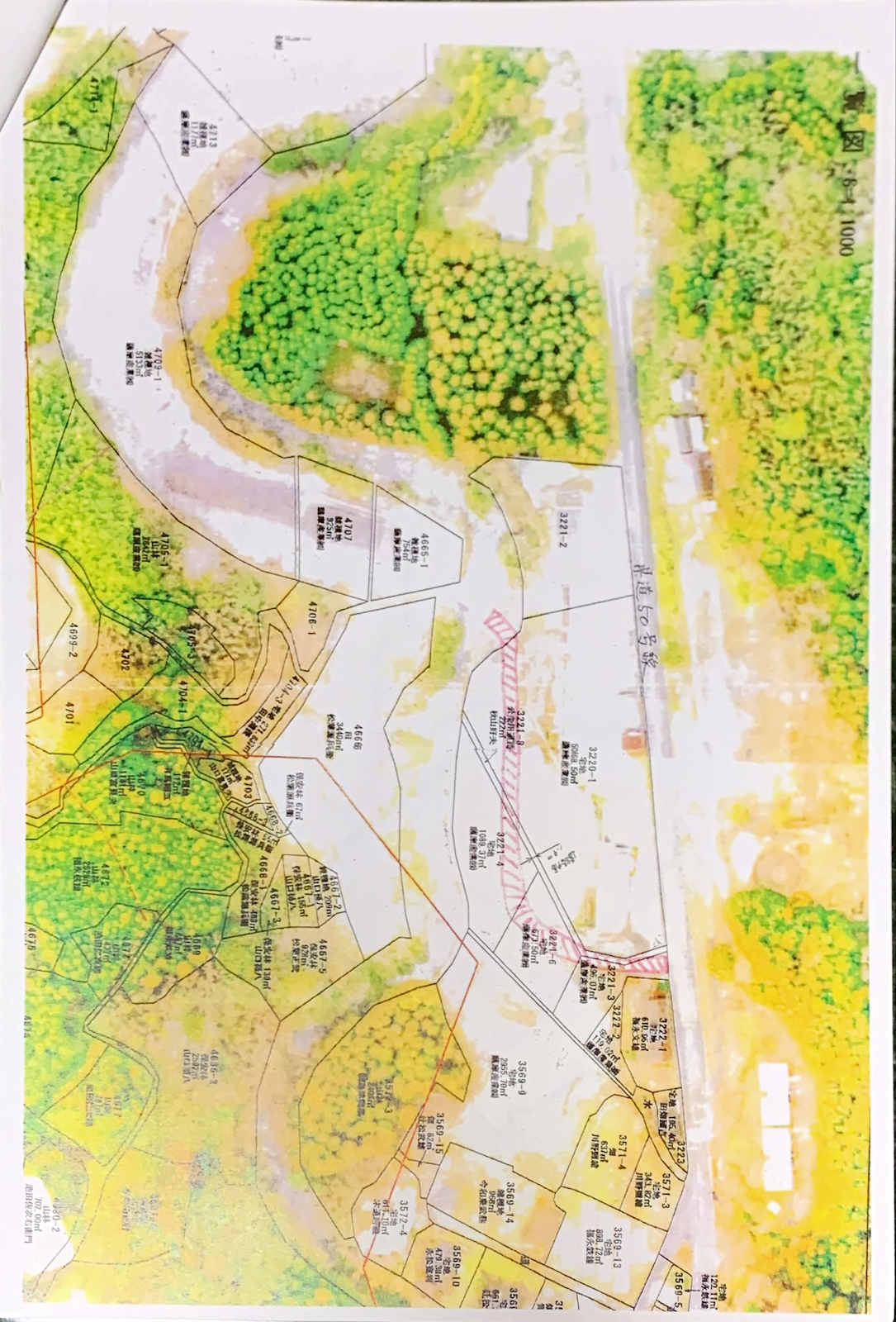

| Title | 4 contiguous licences valid to 2038; transferable under Japanese Mining Law |

| Ownership Target | Nagano Kin Co., Ltd. (private, debt-free, no environmental liabilities) |

| Last Production | 1953 (closed at US$35/oz gold) |

| Depth Mined Historically | ~150 m (technology-limited) |

| Modern Exploration | <3 000 m of diamond drilling (2019-2025) by Irving-led JV |

| Infrastructure | Paved access, grid power, water line, 50 km to Kagoshima Port |

| Permits | Exploration permits active; mining-right transfer pre-approved |

3. Work Already Done – free data package included

All information below is public-released by Irving Resources (JV operator) and will be delivered to Lithireum on closing.

- Geophysics: Airborne magnetics, CSAMT and high-resolution gravity completed over 13.4 km² – a buried dacite dome (identical to Hishikari) has been modelled beneath post-mineral cover.

- Drilling: 5 deep diamond holes (2019-2025) including:

- 9.6 m @ 1.38 g/t Au incl. 5 m @ 2.9 g/t Au and 1 m @ 8.3 g/t Au

- 0.5 m @ 8.54 g/t AuEq at 492 m down-hole (hole 25SY-001)

- Geology: 40+ epithermal quartz-adularia veins mapped; low-sulphidation alteration zonation confirmed; fluid-inclusion temperatures 200-260 °C.

- Metallurgy: Historic cyanidation recoveries 90-95 %; modern CIL test-work underway (ALS Labs).

- ESG: Community MOU signed with Satsuma-town; rehabilitation work (10 000-tree programme) already budgeted by JV.

4. Quantified Gold Potential – using Irving’s public data

Irving has not released a mineral-resource estimate, but their 2025 exploration target (public slide deck) gives the range used for Lithireum’s financial model:

| Parameter | Low Case | High Case |

|---|---|---|

| Tonnes | 0.5 Mt | 2.0 Mt |

| Grade | 3 g/t Au | 8 g/t Au |

| Contained gold | ≈ 50 koz | ≈ 500 koz |

| Depth extension | 300 m | 600 m |

| Strike length open | 1.2 km | 3.0 km |

This conceptual exploration target (not a mineral-resource) is the basis for the 500 koz upside case embedded in Lithireum’s base-case model.

5. What Happens Next?

| Milestone | Timeline | Purpose |

|---|---|---|

| LOI signed | June 2025 | Exclusive 90-day due-diligence period |

| Resource drilling | Q-4 2025 | 3 000 m HQ core program(funded from US$10 M exploration budget) |

| NI 43-101 report | Q-2 2026 | Maiden inferred resource estimate |

| Financial Close | Q-2 2026 | US$24 M EXIM facility + US$5 M Japanese subsidies draw |

| First gold pour | Q-4 2027 | 100 tpd gravity + CIL plant commissioning |

6. Bottom line

Lithireum is acquiring the same ground that Newmont, Sumitomo and Irving are currently drilling – but before they publish a resource or exercise their own purchase option.

That means:

- Zero exploration cost to Lithireum for the first 3 000 m of core (already paid for by the JV).

- A free, modern geological data package delivered at closing.

- A fully permitted, past-producing mine with clear upside to 500 koz in a Tier-1 mining jurisdiction.

“We are not just buying a mine – we are buying a fully drilled, fully derisked gold district that has waited 400 years for modern capital.”